There are more pleasant accounting tasks than paying bills, but QuickBooks Online organizes and simplifies this critical chore of keeping up with bills.

The Two-Step Process

Before you can start paying bills, you have to enter them into QuickBooks Online (QBO). This will entail a bit of extra work the first time to set up a vendor, but there are numerous benefits to handling your accounts payable in this fashion, like:

- Speed. Once you’ve created a framework (template) for a bill, it will take minimal time to pay it in the future.

- Documentation. All of your bill payments will be recorded in QBO, so you won’t have to hunt through checkbook registers or file folders to see if a bill was paid.

- Timeliness. QBO will always remind you when a bill must be paid (if you’ve set it up correctly).

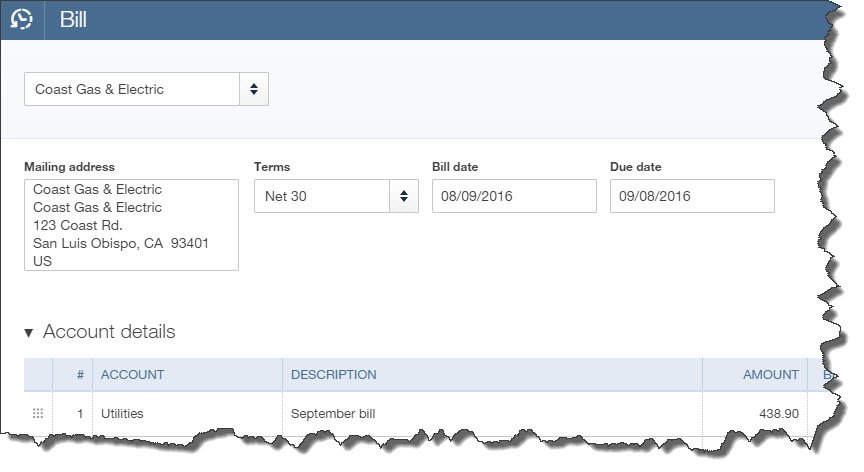

To enter a bill, click the plus (+) sign at the top of the screen and click on Vendors and then Bill. This screen opens:

Looks pretty simple, doesn’t it? It is – if you have a simple bill like the one you receive for gas and electricity. You select the vendor by clicking on the arrow next to the blank field in the upper left and choosing from the list that opens. The Mailing Address and Terms should fill in automatically if you’ve done all of your initial QBO setup. If not, you can add and edit this information.

Bill date refers to the date of the bill itself, not the day payment is due to the vendor. That date goes in the Due date field. Select your Account from the list that opens when you click in that field, and enter a Description and Amount. If that’s all that’s required for that bill, you can save it and proceed to the next. It’s now recorded as a bill that needs to be paid.

Recurring Payments

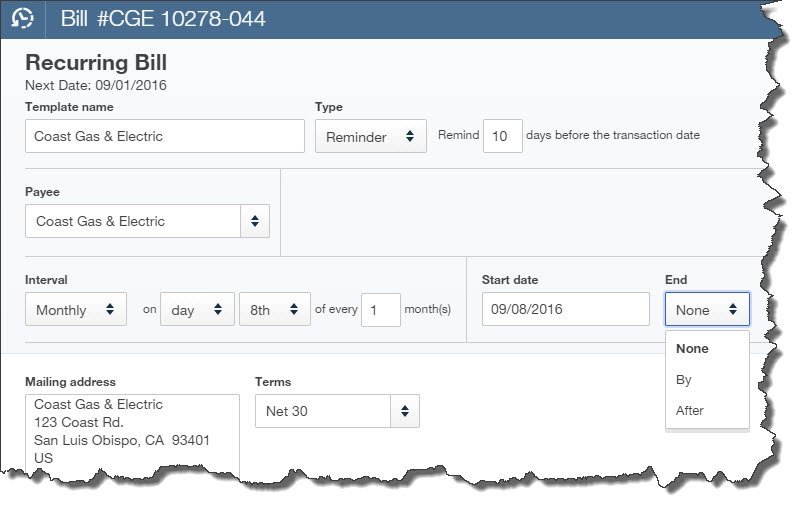

Some of your bills are a one-time only, but others arrive on a regular basis. So QBO has tools that will minimize the time required to process them after you’ve entered the basic information once. After you’ve completed a bill, click Make recurring at the bottom of the page to see this screen:

This screen is self-explanatory. You simply tell QBO how much notice you want before a bill’s due date so you can process the payment. Take care with this screen to avoid paying bills too early, which affects your cash flow unnecessarily, or too late.

You have three options when you’re creating a Recurring Bill template. You’ll choose one from the list that opens when you click the arrow in the Type field:

- Scheduled. This is best used when the details of a transaction don’t change, like rent or a loan payment. You don’t have to do anything for the payment to be dispatched; it’s done automatically for you at the interval you set. You can, however, ask to be notified every time this occurs.

- Reminder. You could use this for periodic payments that will require editing before they’re sent. For example, you’ll probably need to change the amount on your utility bills every month. QBO will place a reminder in your Activities list on the home page.

- Unscheduled. If you have bills that contain a great deal of detail but aren’t due on a set schedule, you can save the template and call it up when you need it by clicking the gear icon in the upper right and selecting Recurring Transactions.

Next month, we’ll talk about the process of paying bills. If in the meantime you start entering bills and find that you’re having trouble completing the fields required for more complex bills, call us at 256-337-5200 to schedule a session or two. It’s always best to have one-on-one training to utilize the advanced tools with any software.